- Home Loan

- Personal Loan

- Car Loan

|

|

Loan EMI

Total Interest Payable

Total Payment

(Principal + Interest)

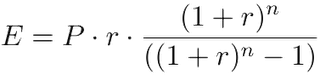

In todays world of meteoric change, the intrinsical core values of earning & spending have denatured & Loans have become an inherent part of our life. They have become an indispensable & epochal instrument to accomplish our goals. Whether you plan to buy a house, car or plan for higher education, loans have made it effortless for most of us to afford the things we desire. EMI is the initial word with momentous value, that strikes our mind when we talk about loans. EMI is Equated Monthly Installment & it is the repayment of loan by a borrower to the bank or institution from where loan has been taken. This repayment is done on a monthly basis and is based on varied interest rates for different loans like car loan, house loan, personal loan etc. Here is the formula to calculate the EMI:

Here E is the EMI.

P is the principal loan amount taken by you.

R is the rate of interest per month.

n is the tenure for which you have taken the loan.

Let's have a look at simple calculation of EMI for a loan amount of Rs. 15,00,000 at interest rate of 13% for 7 years:

E = ₹15,00,000 * (13÷(12×100)) * (1 + (13÷(12×100))84 / ((1 + (13÷(12×100))84 – 1) = ₹27,288

Conversion of annual interest rate to monthly rate of interest: r ÷ (12×100) where r is annual interest rate. The interest component is the one of the most striking component of EMI especially at the initial stages of your loan repayment; however, as you progress ahead in the loan tenure the interest lowers down.

Unlike the good old days, the modernistic world has brought everything at the tip of your fingers, so has the calculation of EMI which is done in an automated mode by a EMI calculator. Apt work by ALSOFT agile team have formulated an inbuilt EMI calculator that abbreviate the task of calculation of EMI and gives you a snapshot of your monthly installments depending on the kind of loan and interest rate.